how to lower property taxes in maryland

Most other states have a system whereby. Property tax bills are issued in JulyAugust of each year by Marylands 23 counties and Baltimore City as well as the 155 incorporated municipalities in Maryland.

Your local tax collectors office sends you your property tax bill which is based on this assessment.

. In order to come up with your tax bill your tax office multiplies the tax rate by. This detailed report tells you everything you need to know about reduc. Tax bills are rendered for the.

While the state government handles property assessments in Maryland local governments still set their own tax rates. Maryland Property Tax Appeal From A to Z. Learning about actions that can help you reduce property taxes is necessary for every property owner.

This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland. Use our tips and you will find your property tax. If you have questions please contact.

Maryland is one of only seven states that require homeowners to pay a years worth of property taxes in advance upon closing a real estate deal. What is the Homeowners Property Tax Credit Program. 8 ways to lower your property taxes and get some money back Review your property tax card.

Maryland Property Tax Rates. Learn more about each tax credit or tax relief program below. The State of Maryland has developed a program which allows credits against the homeowners property tax bill if the.

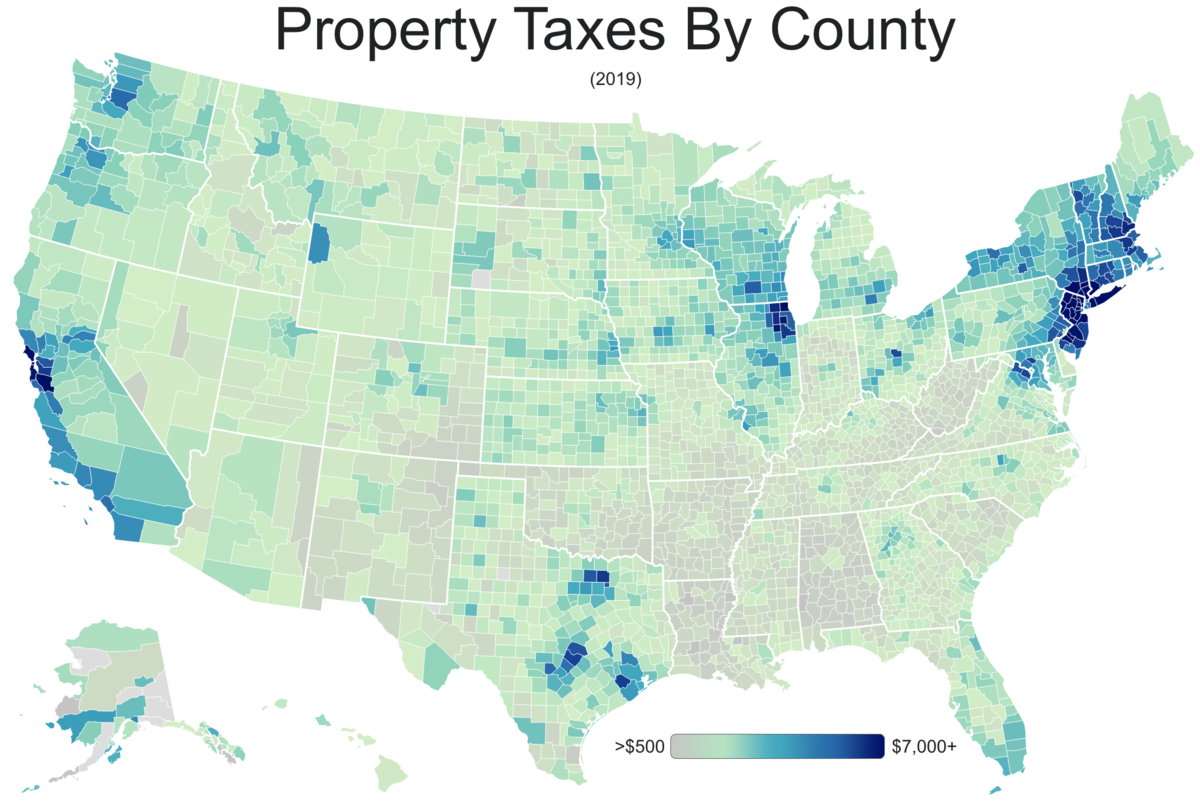

Property tax can be confusing at the best of times but DoNotPay is here to help. The average property tax bill in Maryland ranges between 1403 and 5389. Downloadable applications are available for most credits and programs.

Property tax is determined by multiplying the property tax rate in your area by your homes current value. One of the most efficient methods is the. For example in New Mexico the property tax rate is about 79 percent.

Maryland offers a property tax exemption to Veterans that have a service-connected 100 permanent and total or. So if a propertys market value is determined to be 100000 and the assessment ratio is 80 percent the assessed value for property tax purposes would be 80000. As is the case with most states.

Maryland Disabled Veterans Property Tax Exemption. For business tax liabilities call 410-767-1601. Maryland has a property tax rate of 106 which is slightly lower than the national average of 107.

When you use UpNest to find the best local Realtors you can be confident. Get a copy of your property tax card from the local assessors office. If your name appears in the listing you should contact the Comptrollers Office to make arrangements to resolve the liability.

How can I lower my property taxes in Maryland. While some cities and towns in Maryland impose a separate property tax rate for property in that jurisdiction most agricultural land is not found within those boundaries. This detailed report tells you everything you need to know about reduc.

The purpose of this program is to help reduce the amount of monies needed at the time of settlement. Subsequently Maryland has the 24th highest property tax rate in the country. DoNotPay Helps You Reduce Your Maryland Property Tax Bill.

This Free Report will show you EXACTLY how to reduce your Property Taxes in Maryland. Tax rates in the county are roughly.

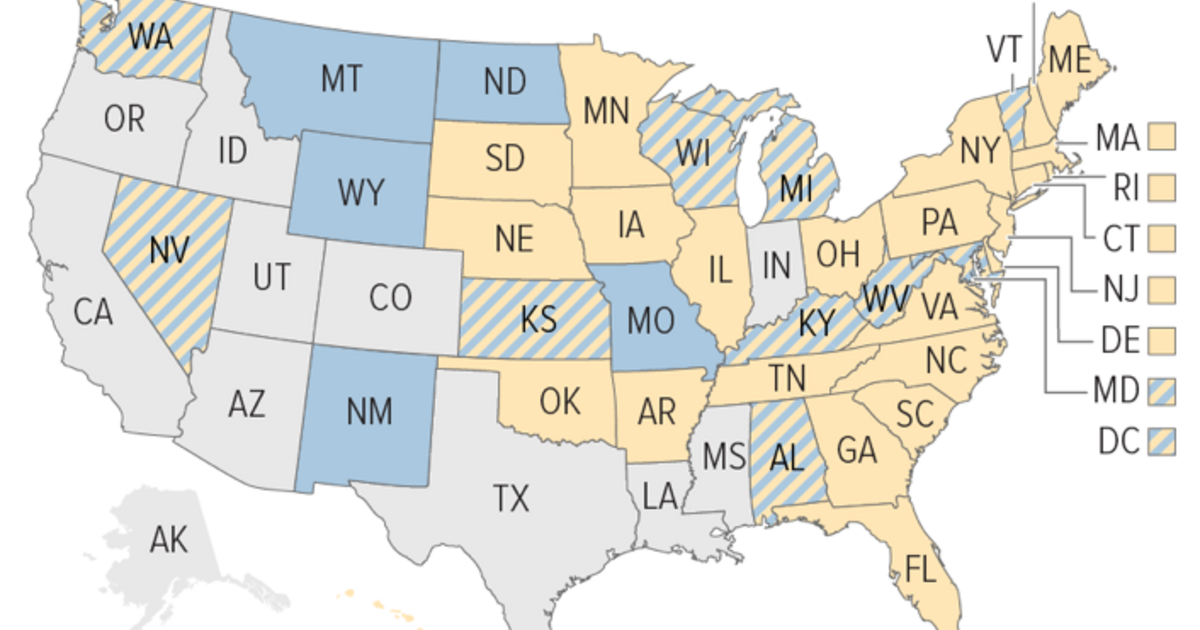

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Historical Maryland Tax Policy Information Ballotpedia

Maryland Property Tax Calculator Smartasset

Property Tax Comparison By State For Cross State Businesses

Deducting Property Taxes H R Block

How To Appeal Your Property Tax Assessment The Washington Post

New Jersey Education Aid How Maryland Does It How Another Deep Blue State Has Much Lower Property Taxes Than New Jersey

Property Tax Exemptions And Payments In Lieu Of Taxes Local Revenue Effects Conduit Street

Lower My Md Property Taxes Maryland Property Tax Lower Reduction In Property Taxes In Maryland Youtube

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

Un Sweetened How A Maryland County Cut Soda Sales Without A Soda Tax The Salt Npr

Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

Frequently Asked Questions Maryland Property Tax Assessment Appeals Boards

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Your Guide To Maryland Real Estate Taxes Upnest

Property Tax In The United States Wikipedia

Maryland Vehicle Sales Tax Fees Maryland Find The Best Car Price