wa sales tax calculator

Local tax rates in Washington range from 0 to 39 making the sales tax range in Washington 65 to 104. Before-tax price sale tax rate and final or after-tax price.

How High Are Spirits Taxes In Your State Tax Foundation

Our income tax calculator calculates your federal state and local taxes based on several key inputs.

. A downloadable tax calculator workbook using Microsoft Excel that displays tax rates and location codes calculates totals and summarizes sales by city or county without an online. Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 To learn more about sales tax in Seattle Washington continue. Washington state regulators are charging consumers a double sin tax on liquor.

Look up a tax rate on the go. Use this search tool to look up sales tax rates for any location in Washington. Vancouver is located within Clark County.

Multiply price by decimal. With an 86 Sales Tax here in Burlington WA and start saving. 65 100 0065.

The price of the coffee maker is 70 and your state sales tax is 65. Search by address zip plus four or use the map to find the rate for a specific location. This calculator shows the amount of each tax the total you pay and the percentage of the total and original.

The state sales tax rate in Washington is 6500. Divide tax percentage by 100. 54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Washington local counties cities and special taxation. This includes the rates on the state county city and special levels. The base state sales tax rate in Washington is 65.

ZIP--ZIP code is required but the 4 is. The average cumulative sales tax rate in Vancouver Washington is 847. List price is 90 and tax percentage is 65.

Your household income location filing status and number of personal. Groceries and prescription drugs are exempt from the Washington sales tax. Washington has recent rate changes Thu Jul 01.

The Washington state sales tax rate is 65 and the average WA sales tax after local surtaxes is 889. Youll find rates for sales and use tax motor vehicle taxes and lodging tax. With local taxes the total sales tax rate is between 7000 and 10500.

Use our online sales tax calculator then speak with the auto finance experts at our VW dealer near Marysville WA.

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

Business Guide To Sales Tax In Washington Dc

Payroll Tax Calculator For Employers Gusto

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

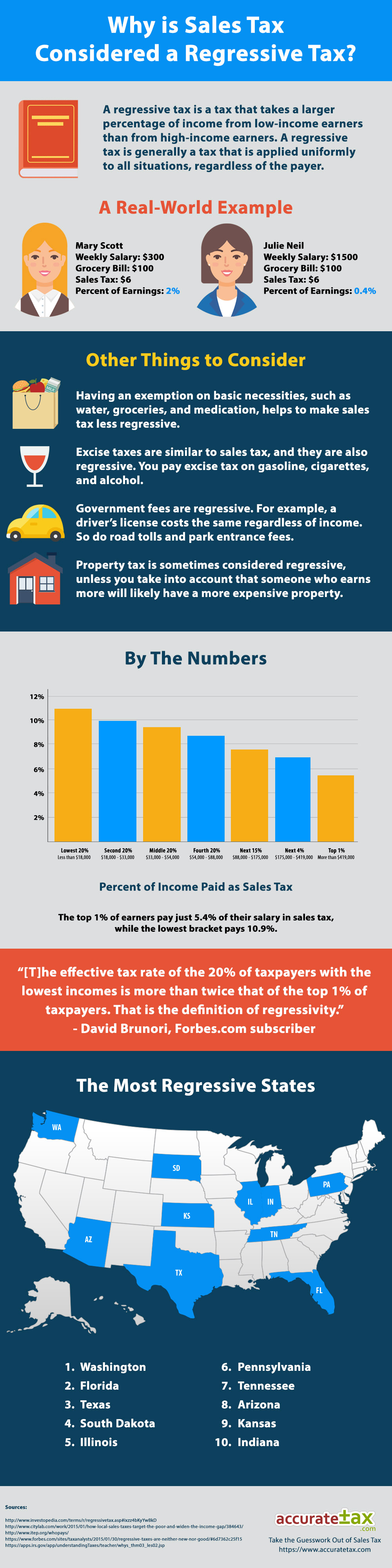

Is Sales Tax Regressive Sales Tax Infographic

Taxjar State Sales Tax Calculator Sales Tax Nexus Tax

Llc Tax Calculator Definitive Small Business Tax Estimator

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Woocommerce Sales Tax In The Us How To Automate Calculations

States With The Highest And Lowest Sales Taxes

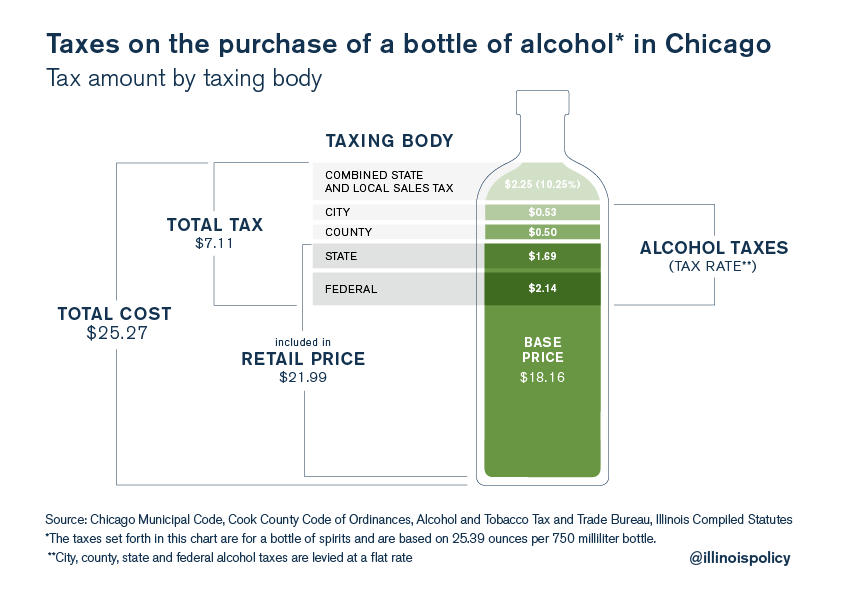

Chicago S Total Effective Tax Rate On Liquor Is 28

Wa Sales Tax Rate Lookup Apps On Google Play

10 States With The Highest Sales Taxes Kiplinger

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

Free Llc Tax Calculator How To File Llc Taxes Embroker